Billionaire Michael Jordan has marked himself as a shrewd investor. Now, the National Basketball Association (NBA) legend is investing in his passion for luxury collectibles.

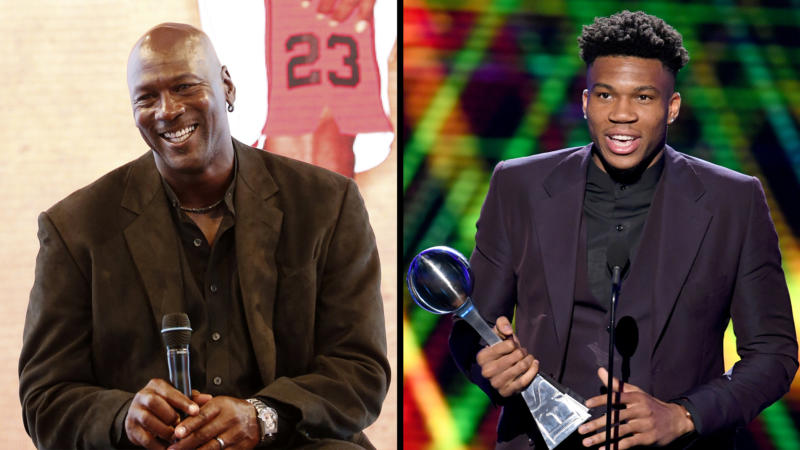

WatchBox, an e-commerce platform for collectible luxury watches, has secured a $165 million round of equity capital, according to a press release. It was led by The Radcliff Companies and The Spruce House Partnership. Other participants include CMIA Capital Partners and NBA stars such as Michael Jordan, Giannis Antetokounmpo, Chris Paul, Karl Anthony Towns and Devin Booker.

“Our investors and partners hail from a wide range of industries, from consumer to technology, finance and professional sports, yet we are all bound by our love of watches. When we founded WatchBox, our vision was to build a brand that would engender trust so that we could unite a passionate network of enthusiasts. With that foundation we are now able to use technology to create the best customer experience in the industry,” said Justin Reis, WatchBox Co-Founder and Global CEO, in a press statement.

WatchBox has yet to reveal the details of its latest valuation. However, individuals who prefer to remain anonymous have disclosed to CNBC that WatchBox is reportedly on its way to a valuation of $1 billion. In addition, the company is set to reach $300 million in net revenue by the end of the year and could obtain an initial public offering (IPO) sometime in the future, Reis revealed.

WatchBox’s ambitious raise will be used to reach new markets and scale its digital platform to revitalize its inventory selection, which is currently valued at $150 million.

“We are reshaping the way high-value luxury is transacted online,” Reis said, according to a press release. “We built our proprietary concierge platform to enable efficiency and scale as we build personal connections with collectors around the world. We have an incredible group of dedicated people at WatchBox and, as we reach major milestones such as this one, I feel especially grateful to our team who have all contributed to our growth and success to date.”